Nicholas Jackson, JUL 19 2011, 10:51 AM ET

This morning, John Talbott, author of How I Predicted the Global Economic Crisis, argued that Facebook is undervalued. This despite trading on the secondary market that values the social network at somewhere between $80 billion and $100 billion. Talbott’s argument, which rests on Facebook’s ability to monetize its enormous user base (750 million and still growing), contributes to a long-running discussion about whether or not we’re currently in the middle of a tech bubble.

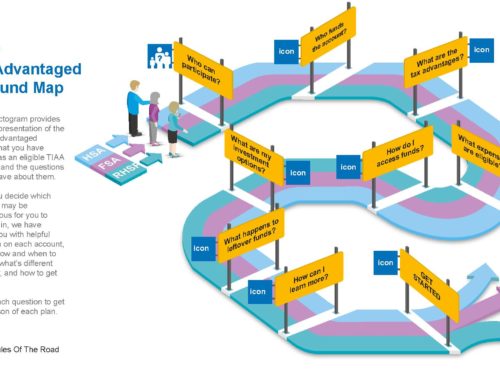

This infographic, released by KISSmetrics and FeeFighters, is the best attempt we’ve seen to summarize the issue with charts, graphs and figures. “Rampant speculation. Overvaluation. Unrealistic growth expectations. With such language being used to describe current market conditions we can’t help but wonder — are we headed for another Dot-Com bubble?,” reads this infographic’s introduction. “Here’s the data so you can decide for yourself.”

Infographics are always a bit of a hodgepodge of statistics culled from a variety of sources. Here, we sort through the clutter and pull out some of our favorite facts and figures:

- Although it may seem that recently (2009-2011) startups haven’t had problems raising capital, the level of venture investment currently pales in comparison to levels during the .com bubble. A lot of people are talking about an early stage bubble, but even in early stage deals, we’re nowhere near the .com bubble.

- Even with the seemingly high number of recent tech IPOs, historical data suggests that the number of current tech IPOs is drastically smaller than during the .com bubble.

- When most people think of the .com bubble of the ’90s, the think of the giant run-up in tech stocks. The pace at which the Nasdaq 100 index shot up (10x in four years) was impressive and every individual investor wanted a piece of the action. Fortunately, we don’t seem to be approaching the craziness of that time.

- Today, tech companies have access to a relatively large pool of potential customers — something that the tech companies of the .com bubble didn’t have. In 2010, there were 10 times the number of Internet users there were in 2000. The current number of active Facebook users is equal to the number of total Internet users there were in 2002.